05.10.19

Estimating the Cost of College

James V. Petitpren, II

It does not take a degree in finance to see the cost of college continues to rise.

In its 2017 report, the College Board showed that public four-year institutions raised prices an average of 3.2% annually between the 2007-08 and 2017-18 school years. Put another way, a $5,000 education in 2007-08 would cost $6,851 in 2017-18.

For a few families, the lion’s share of education costs falls on parents and, in some cases, on grandparents. Generally the majority of families rely on a combination of scholarships, grants, financial aid, part-time jobs, and parent support to help pay the cost.

Tip: Public Costs. Average in-state tuition and fees for public four-year institutions was $9,970 for the 2017-2018 school year. Out-of-state tuition for these same institutions averaged $25,620. Source: College Board, 2017

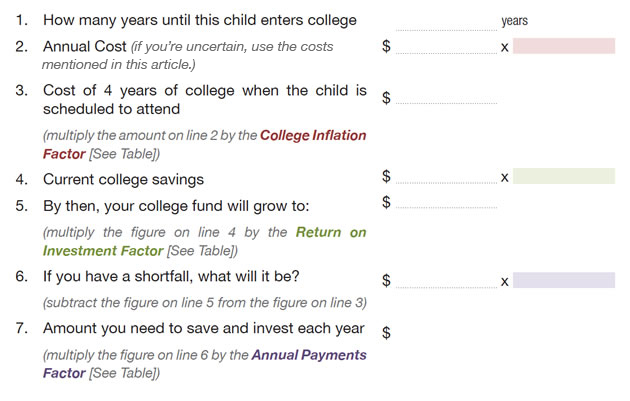

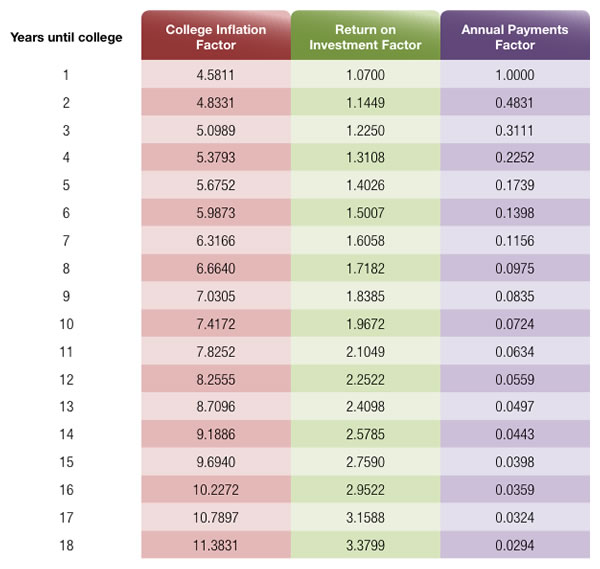

If your child is approaching college age, a good first step is estimating the potential costs. The accompanying worksheet can help you get a better idea about the cost of a four-year college.

If you have already put money away for college, the worksheet will take that amount into consideration. If you have not, it is never too late to start.

Fast Fact: Private Costs. Tuition and fees for private four-year institutions averaged $34,740 for the 2017-2018 school year. If you add room and board, the figure rises to $46,950. Source: College Board, 2017

Resources

There are a number of resources that can help individuals prepare for college. The U.S. government distributes certain information on colleges and costs. Here are two sites to consider reviewing:

www.studentaid.ed.gov

The government’s college and financial aid portal.

www.collegeboard.org

The group that administers the SAT test.

Estimating the Cost of College

For more information, contact James Petitpren at [email protected] or 312.670.7444, or visit ORBAWealthAdvisors.com.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.

Disclaimer

Disclosure

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request. As with any investment strategy, there is potential for profit as well as the possibility of loss. We do not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. The underlying holdings of any presented portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Past performance is not a guarantee of future results.

Our website offers general information about our services and should not be acted upon without obtaining specific advice from a qualified professional. The information provided is not intended to provide any investment, tax or legal advice; in addition, nothing on this website should be considered a solicitation for the purchase or sale of any security. The information contained in this presentation has been compiled from third party sources and is believed to be reliable, but its accuracy is not guaranteed and should not be relied upon in any way, whatsoever.

Third Party Websites:

We may utilize third party service providers to provide certain tools and/or programs, some of which may be housed on a third-party server or on a website which has been independently developed by others. As such, while accessing this website you may be linked to such other third-party servers. Access to other websites or use of any third-party tools or programs on this website are subject to all terms and conditions found therein.

Check the background of your financial professional on FINRA’s BrokerCheck.

Securities offered through LPL Financial. Member FINRA/SIPC. Investment advice offered through ORBA Wealth Advisors, LLC., a registered investment Advisor. ORBA Wealth Advisors, LLC is a separate entity from LPL Financial.

Leaving Site Disclaimer

The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this web site. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for your use of the web sites you are linking to.

Click here to proceed